Finance

Simply AVS work with one of the most experienced funders in the UK, who specialise in leasing and asset funding and can assist with financing audio-visual equipment over a fixed term that suits your institution.

CONTACT OUR TEAM

Our team have the knowledge and experience to help customers design, select and integrate technology solution and equipment to best meet their needs.

CALL - 01635 597044

Contact NowFinance:

Alongside our financing partners, we can offer you financing options, in any sector, that covers IT and software. Whether you are the education, sector, corporate sector or entertainment sector, we have several options for you to choose from. We can offer you:

- Operating Leases- An Operating Lease is where you would be able to lease and use an asset for a particular period of time. In this time, you do not have any ownership rights to the asset, and it is essentially like borrowing. This period of time is usually shorter than the life of the asset, therefore, giving the asset back after this period has ended.

- Finance Leases- A Finance Lease is where a customer will rent equipment for most of the item’s useful life. In this situation, you will have some sort of operating control over the equipment you have rented.

- Business Loans- A Business Loan is a lot broader than just loaning someone equipment. This type of loan is where a lender would loan a business money, and the business would pay back the money in an agreed period of time.

Leasing in Education: Why should you lease equipment?

Working closely with our financing partners, we can help you organise efficient finance leasing, and spread the costs of new equipment for your schools.

Leasing offers you peace of mind, and helps you spread the cost of buying new equipment and software for your schools. Over the course of 1-7 years, you can finance new assets like computers, laptops and software, to save you from waiting for next year’s budget to buy the equipment your school needs. In simpler terms, if you need new equipment now, do not hesitate to buy the necessities, even if its not within your budget for this month – that’s what leasing is all about!

Anything you need for your classrooms, we can help! From the usual computers and software to student laptops and wireless technology. We care about education, and making students’ experiences the best they can be, which is why we believe so strongly in education leasing.

If there is something unusual that you are wondering whether we can lease to you, please contact us at [email protected]

Here are some things that we can do for you:

- Arrange laptops for parents/teacher schemes.

- Insurance for all new school equipment.

- 100% software funding.

- Pyramid leases – larger schools can apply for funding and pass the benefits of lower rates on to its feeder primaries.

- Buy Now Pay Later, where you can guarantee you will always have the equipment you need, even if it doesn’t meet your budget at that time.

- Rescheduling rental payments if you are struggling with tight budgets.

- Inclusion of more than one supplier on your lease contract.

- Technology refresh option when upgrading equipment, if new tech is required.

- Inclusion of entire IT installation – hardware, software, telecoms, cabling, training, peripherals, furniture and licenses.

- Assistance with sourcing equipment.

Benefits of equipment leasing:

Leasing can be an excellent way for school to stay up to date with the latest technology and supply their students everything they need for an efficient learning experience. Equipment leasing for schools is an affordable and flexible way to acquire new equipment for your school. Leasing has been around for a very long time and is a sensible way to acquire new assets. By spreading the cost of an invoice over a term ranging from 1 to 5 years, you are also spreading the VAT, reducing your tax bill, and protecting cash flow. Acquiring new equipment for your school through leasing also means you can plan for upgrades much more easily giving you incredible flexibility by only paying for the usage and not the full cost of the asset. This helps you stay ahead and always allows you to have the best equipment for your school.

Here are all the things your school will benefit from if you choose us:

- Immediate access to equipment – You can spread the cost of an asset across a set period of time and still get the equipment, even if the whole price of the asset isn’t yet paid off.

- Easier budgeting – Fixed rentals allow you to plan for the future.

- Tax efficiency – Rentals are fully allowable against taxable profit, therefore, reducing the net cost of acquiring the equipment.

- Tailored Payments - Rental agreements may be individually tailored to meet budgetary requirements. (Agreements may be for terms from 1 year to 6 years, and can incorporate holiday periods, irregular profiles and stepped rentals).

Alongside our financing partners, we can offer you financing options, in any sector, that covers IT and software. Whether you are the education, sector, corporate sector or entertainment sector, we have several options for you to choose from. We can offer you:

- Operating Leases- An Operating Lease is where you would be able to lease and use an asset for a particular period of time. In this time, you do not have any ownership rights to the asset, and it is essentially like borrowing. This period of time is usually shorter than the life of the asset, therefore, giving the asset back after this period has ended.

- Finance Leases- A Finance Lease is where a customer will rent equipment for most of the item’s useful life. In this situation, you will have some sort of operating control over the equipment you have rented.

- Business Loans- A Business Loan is a lot broader than just loaning someone equipment. This type of loan is where a lender would loan a business money, and the business would pay back the money in an agreed period of time.

Get in touch to discuss your finance needs.

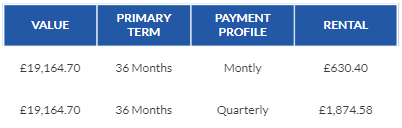

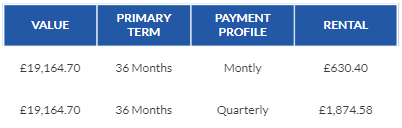

Example Leasing Quote

Please see below example leasing quote based on the Hisense 86WR60AW model. This can be adjusted to the required term of the school.

If you have any questions or would like to discuss further please let us know.

10x Hisense 86WR60AE

Benefits of equipment leasing.

- Cashflow

- Risk management

- Flexible leasing term

- Upgradable

- Easier budgeting

- Easy

- Flexible payment options